Federal prosecutors have charged the founder and accountant of a Florida nonprofit with stealing $100 million intended for special needs victims.

An unsealed indictment accuses the two men of orchestrating a scheme to siphon off over $100 million from a nonprofit that managed funds for individuals with disabilities and other special needs.

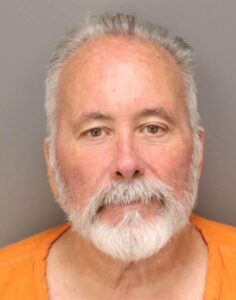

According to court records, Leo Joseph Govoni, 67, of Clearwater, co-founded the Center for Special Needs Trust Administration (CSNT) around 2000. John Leo Witeck, 60, of Tampa, worked there as an accountant.

CSNT was established to manage money for people with disabilities, including individuals who received settlements, court awards, or other payments. Over time, CSNT became one of the country’s largest administrators of special needs trusts, serving beneficiaries across nearly every state. By February 2024, it oversaw more than 2,100 special needs trusts, totaling roughly $200 million in assets.

“For over 15 years, the defendants conspired to use the funds of special needs clients as a personal piggy bank,” said Matthew R. Galeotti, Head of the Justice Department’s Criminal Division. “They stole $100 million meant for the most vulnerable members of our society to enrich themselves. Today’s charges show our continued commitment to pursuing fraudsters who abuse trust. Thanks to our law enforcement partners, we will keep fighting for justice.”

The indictment alleges that from June 2009 to May 2025, Govoni, Witeck, and others solicited, stole, and misused CSNT clients’ funds, using them as a personal slush fund. They allegedly hid their crimes through intricate financial transactions and deceit, including sending fraudulent account statements with fake balances to victims. Govoni reportedly used the stolen funds to buy real estate, fly on private jets, finance a brewery, pay off personal debts, and transfer money to his own bank accounts. CSNT declared bankruptcy in 2024, revealing that over $100 million was missing from client trust accounts. Govoni also allegedly made false statements to the bankruptcy court during those proceedings.

In a separate offense, Govoni is accused of committing bank fraud involving a $3 million mortgage refinance loan. He allegedly laundered over $205,000 of that money to pay off a home equity line of credit on his house.

“Protecting the most vulnerable is a top priority,” said U.S. Attorney Gregory W. Kehoe for the Middle District of Florida. “The level of fraud in this case is staggering. Our dedicated law enforcement partners have worked tirelessly to bring justice in this matter.”

Govoni and Witeck face charges including conspiracy to commit wire and mail fraud, wire fraud, mail fraud, and money laundering conspiracy. Govoni is also charged with bank fraud, illegal monetary transactions, and making false declarations in bankruptcy.

If convicted, both men face up to 20 years in prison for the wire fraud, mail fraud, and conspiracy charges. Govoni faces an additional 30 years for bank fraud, 10 years for illegal monetary transactions, and five years for false bankruptcy declarations.

“The accused created a slush fund that drained millions from an organization helping people with special needs,” said FBI Assistant Director Jose A. Perez. “They betrayed the community’s trust and bankrupted a lifeline for vulnerable families. The FBI won’t stand by when charitable missions are abused for personal gain.”

“The sheer scale and boldness of the alleged fraud are alarming,” said Guy Ficco, Chief of IRS Criminal Investigation. “Stealing from people with special needs is not just criminal—it’s cruel. Our agents will continue to unravel financial schemes that target society’s most vulnerable.”

“This defendant disrupted vital services for people with disabilities and defrauded federal health care programs to fund a lavish lifestyle,” said Christian J. Schrank, Deputy Inspector General for Investigations at HHS-OIG. “We will continue working with our law enforcement partners to ensure full accountability.”

An indictment is merely an accusation, and all defendants are presumed innocent until proven guilty in court.

The FBI, IRS Criminal Investigation, HHS-OIG, and SSA-OIG are leading the investigation.

Trial Attorney Lyndie Freeman from the Justice Department’s Fraud Section and Assistant U.S. Attorneys Jennifer Peresie and Michael Gordon from the Middle District of Florida are prosecuting the case.

Leave a Reply